Employee Ownership Trusts / The Path to Transforming Your Legacy

The Strategic Buyer Matrix

In today's evolving business landscape, Employee Ownership Trusts (EOTs) are revolutionising how ambitious owners think about their exit. This isn't just another way to sell your business – it's an opportunity to transform lives, secure legacies, and release the full potential of your organisation.

Why EOTs Are Creating New Possibilities

At its heart, an EOT transfers at least 51% of your business to a trust benefiting all employees. But this is about more than ownership structure – it's about creating lasting value and profound change. We're seeing increasing numbers of forward-thinking owners choose this path, attracted by both its tangible and intangible benefits.

The Power of Employee Ownership

Tax Transformation: Qualifying sales achieve zero Capital Gains Tax

Employee Rewards: Tax-free annual bonuses up to £3,600 per employee

Cultural Excellence: Enhanced engagement driving superior performance

Legacy Assurance: Your values and independence preserved

Balanced Transition: Flexible involvement options for sellers

Understanding Your Options: EOT vs MBO

While Management Buyouts (MBOs) remain a proven path, EOTs offer distinct advantages worth considering:

The EOT Journey

Broader stakeholder engagement

Superior tax efficiency

Preserved independence

Stronger employee motivation

Clear succession path

Long-term stability focus

Enhanced employee loyalty

The MBO Alternative

Focused management control

Direct ownership incentives

Traditional funding routes

Faster decision-making

Clear leadership structure

Creating Your Perfect Structure

Whether through pure EOT or a hybrid approach combining EOT and MBO elements, we'll help craft the ideal solution:

The Pure EOT

Maximum tax efficiency

Broadest employee engagement

Clear governance framework

Long-term independence

The Hybrid Possibility

Balanced governance structure

Targeted management incentives

Optimised tax efficiency

Enhanced completion likelihood

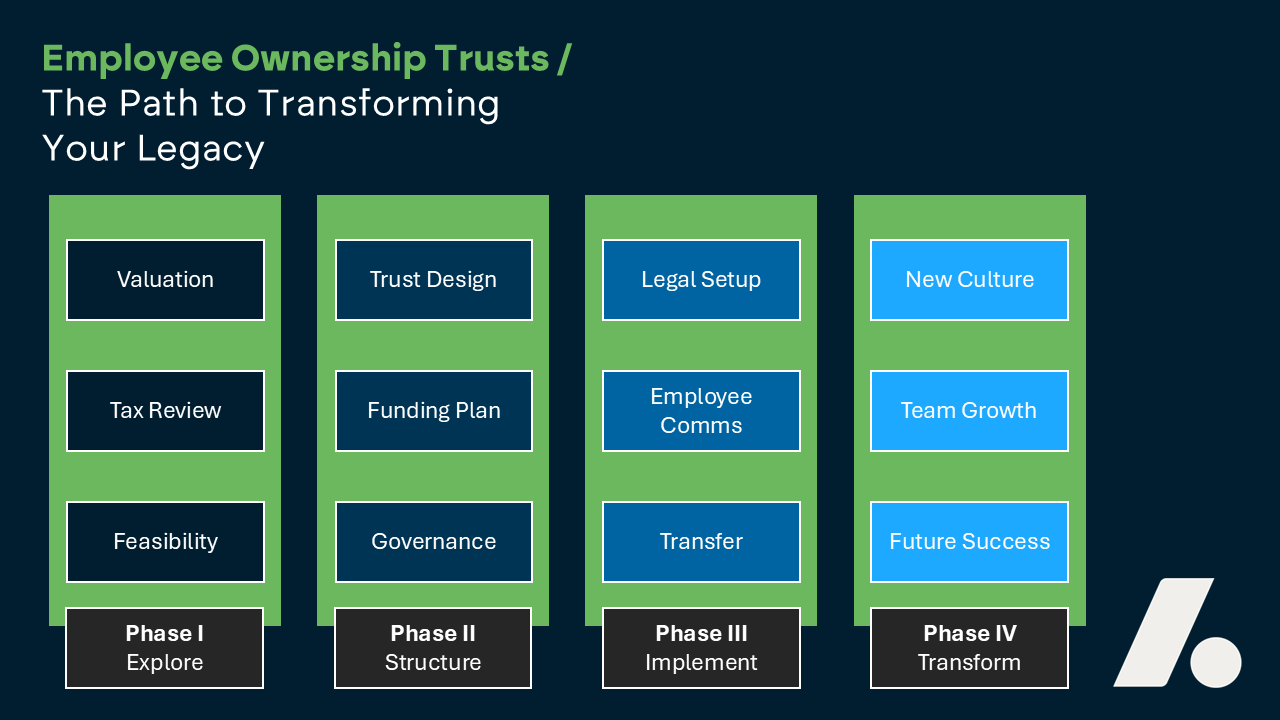

Your Journey to Employee Ownership

We'll guide you through each transformative stage:

Initial Exploration

Comprehensive business valuation

Detailed feasibility assessment

Tax clearance planning

Stakeholder analysis

Structure Design

Trust establishment

Governance framework

Funding strategy development

Management incentive planning

Implementation

Funding arrangement

Legal documentation

Communication strategy

Transaction execution

Ongoing Support

Transition management

Performance monitoring

Cultural development

Strategic guidance

Key Questions to Consider

What's driving your exit strategy? Is it purely financial, or are you looking to create a lasting legacy that transforms both lives and business value?

How important is your company's culture? Would your business thrive with broad employee ownership, or does it need focused management control?

What's your ideal timeline? Are you looking for an immediate exit, or would you prefer a phased transition that ensures lasting success?

Release Your Business's True Potential

This is more than a business transaction – it's about transforming possibilities into reality. At Alinea, we understand the weight of this decision because we've guided numerous owners through this exact journey. Our experience, coupled with our obsession for detail and rigorous approach, ensures you'll move forward with absolute confidence.

Ready to explore how an EOT could transform your business's future? Let's start a conversation about your ambitions. Contact our EOT specialist James Shand for a confidential discussion about your possibilities.